This page provides an overview of NBN Co Limited's debt portfolio including domestic and global debt capital market issuances, credit ratings, liquidity position, debt maturity profile, and access to our financial results and sustainability report.

Please note that by accessing and reading the information on this page, you agree to our Terms of use.

Amendment of National Broadband Network Companies Act 2011

On 26 March 2025, the Parliament of the Commonwealth of Australia passed the National Broadband Network Companies Amendment (Commitment to Public Ownership) Act 2025.

The Act (among other things) amends the National Broadband Network Companies Act 2011 to legislate for the ongoing public ownership of the National Broadband Network by repealing provisions in the National Broadband Network Companies Act 2011 which could have facilitated changes to the ownership of NBN Co Limited.

The Act received Royal Assent on 27 March 2025.

Credit Ratings

NBN Co Limited has the following credit ratings:

| Moody's Long Term Issuer Rating | Aa3 (Stable) |

| Fitch's Long Term Issuer Rating | AA+ (Stable) |

| Moody's Short Term Issuer Rating for NBN Co's Promissory Note Programme | P-1 |

| Fitch's Short Term Issuer Rating for NBN Co's Promissory Note Programme | F1+ |

Note: These credit ratings are provided for use by wholesale investors only and must not be used, and NBN Co Limited does not intend or authorise their use, in the support of or in relation to the marketing of financial products to retail investors in Australia.

MSCI Provisional ESG Ratings

Domestic Debt Capital Market Issuances

| Issuance | Amount Issued | Coupon | Maturity | Pricing Supplement |

|---|---|---|---|---|

| AUD MTN | AUD 1,200 million | 1.00% | 3 December 2025 | AMTN Series 1 |

| AUD MTN | AUD 400 million | 2.20% | 16 December 2030 | AMTN Series 2 |

| AUD MTN | AUD 350 million | 2.15% | 2 June 2028 | AMTN Series 3 |

| AUD MTN | AUD 425 million | 3M BBSW + 0.40% | 9 September 2024 | AMTN Series 4 |

| AUD MTN | AUD 400 million | 0.75% | 9 September 2024 | AMTN Series 5 |

| Green AUD MTN | AUD 800 million | 4.20% | 14 April 2027 | Green AMTN Series 6 |

| AUD MTN | AUD 800 million | 4.75% | 28 September 2026 | AMTN Series 7 Tranche 1 $300 million |

| AMTN Series 7 Tranche 2 $500 million | ||||

| Green AUD MTN | AUD 850 million | 5.20% | 25 August 2028 | Green AMTN Series 8 |

| AUD MTN | AUD 1,000 million | 3M BBSW + 0.87% | 28 August 2027 | AMTN Series 9 |

| Green AUD MTN | AUD 750 million | 5.00% | 28 August 2031 | Green AMTN Series 10 |

| Green AUD MTN | AUD 750 million | 5.35% | 6 March 2035 | Green AMTN Series 11 |

Global Debt Capital Market Issuances

| Issuance | Amount Issued | Coupon | Maturity | Pricing Supplement |

|---|---|---|---|---|

| US 144A Notes | USD 750 million | 1.45% | 5 May 2026 | GMTN Series 1 |

| US 144A Notes | USD 1,250 million | 2.625% | 5 May 2031 | GMTN Series 2 |

| Private Placement | AUD 200 million | 1.847% | 22 June 2027 | GMTN Series 3 |

| Private Placement | AUD 200 million | 1.557% | 14 July 2026 | GMTN Series 4 |

| Private Placement | NOK 1.25 billion | 2.365% | 20 July 2033 | GMTN Series 5 |

| Private Placement | AUD 50 million | 2.800% | 20 July 2033 | GMTN Series 6 |

| Private Placement | USD 50 million | 1.600% | 4 August 2028 | GMTN Series 7 |

| US 144A Notes | USD 600 million | 0.875% | 8 October 2024 | GMTN Series 8 |

| US 144A Notes | USD 700 million | 1.625% | 8 January 2027 | GMTN Series 9 |

| US 144A Notes | USD 700 million | 2.500% | 8 January 2032 | GMTN Series 10 |

| Private Placement | NOK 1.50 billion | 2.732% | 20 October 2031 | GMTN Series 11 |

| Private Placement | AUD 200 million | 2.2245% | 25 October 2028 | GMTN Series 12 |

| Private Placement | AUD 200 million | 2.553% | 18 November 2028 | GMTN Series 13 |

| Private Placement |

NOK 1.00 billion | 3.947% | 20 April 2032 | GMTN Series 14 |

| Private Placement |

JPY 5.50 billion | 0.900% | 20 May 2034 | GMTN Series 15 |

| Green EMTN | EUR 750 million | 4.125% | 15 March 2029 | GMTN Series 16 |

| Green EMTN | EUR 600 million | 4.375% | 15 March 2033 | GMTN Series 17 |

| Private Placement | HKD 500 million | 4.280% | 23 May 2033 | GMTN Series 18 |

| Private Placement |

HKD 400 million | 4.670% | 21 June 2033 | GMTN Series 19 |

| Private Placement |

GBP 50 million | 5.541% | 23 June 2033 | GMTN Series 20 |

| Private Placement | GBP 100 million | 5.777% | 9 August 2035 | GMTN Series 21 |

| Private Placement | EUR 90 million | 4.294% | 14 August 2035 | GMTN Series 22 |

| US 144A Notes | USD 750 million | 5.750% | 6 October 2028 | GMTN Series 23 |

| US 144A Notes | USD 500 million | 6.000% | 6 October 2033 | GMTN Series 24 |

| Private Placement | HKD 470 million | 4.800% | 7 December 2033 | GMTN Series 25 |

| Green EMTN | EUR 700 million | 3.500% | 22 March 2030 | GMTN Series 26 |

| Green EMTN | EUR 600 million | 3.750% | 22 March 2034 | GMTN Series 27 |

| US 144A Notes | USD 500 million | 4.000% | 1 October 2027 | GMTN Series 28 |

| US 144A Notes | USD 500 million | 4.250% | 1 October 2029 | GMTN Series 29 |

| Sustainability EMTN | EUR 700 million | 3.375% | 29 November 2032 | GMTN Series 30 |

| US 144A Notes | USD 650 million | 4.150% | 16 September 2030 | GMTN Series 31 |

Debt Portfolio and Liquidity1

| As at 31 December 2025 | AUD Millions | ||

|---|---|---|---|

| Available | Utilised | Undrawn | |

| Bank debt facilities (excluding Overdraft facilities) | 10,500 | 1,400 | 9,100 |

| AMTN | 5,700 | 5,700 | - |

| EMTN | 5,519 | 5,519 | - |

| US144A Notes | 8,936 | 8,936 | - |

| Private Placements | 2,260 | 2,260 | - |

| Promissory Notes | 3,751 | 3,751 | - |

| Overdraft facilities | 350 | - | 350 |

| Total Gross Borrowings | 37,016 | 27,566 | 9,450 |

| Unrestricted Cash and Cash Equivalents | 37 | ||

| Total Net Borrowings | 27,529 | ||

| As at 31 January 2026 | AUD Millions | ||

|---|---|---|---|

| Available | Utilised | Undrawn | |

| Bank debt facilities (excluding Overdraft facilities) | 10,500 | 1,200 | 9,300 |

| AMTN | 5,700 | 5,700 | - |

| EMTN | 5,519 | 5,519 | - |

| US144A Notes | 8,936 | 8,936 | - |

| Private Placements | 2,260 | 2,260 | - |

| Promissory Notes | 3,875 | 3,875 | - |

| Overdraft facilities | 350 | 133 | 217 |

| Total Gross Borrowings | 37,140 | 27,623 | 9,517 |

| Unrestricted Cash and Cash Equivalents | 58 | ||

| Total Net Borrowings | 27,565 | ||

1 All foreign currency borrowings are translated into AUD equivalent amounts at the hedged foreign exchange rate on the issuance date.

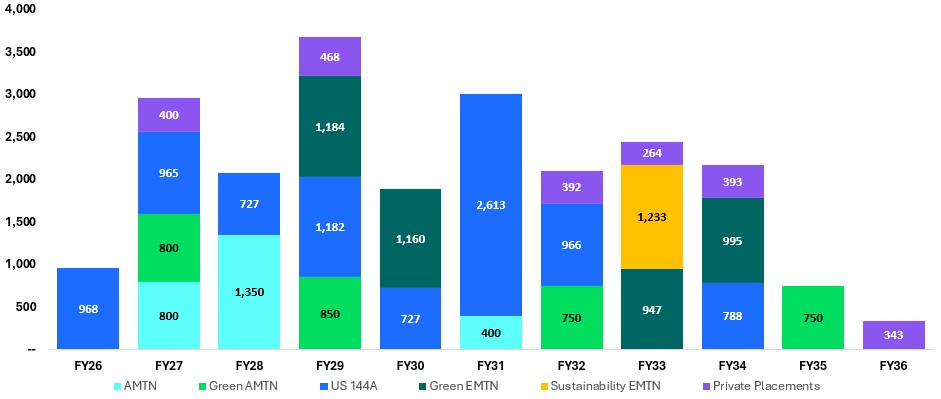

Debt Capital Market Bonds Maturity Profile1

1 All foreign currency borrowings are translated into AUD equivalent amounts at the hedged foreign exchange rate on the issuance date.

| Title | Document |

|---|---|

| Sustainable Bond Reports | |

| Sustainable Bond Report (August 2025) | Download PDF |

| Sustainability Bond Report (August 2024) | Download PDF |

| Sustainability Bond Report (August 2023) | Download PDF |

| Sustainability Bond Report (February 2023) | Download PDF |

| Sustainability Bond Frameworks and Second-Party Opinions | |

| Sustainability Bond Framework (June 2024) | Download PDF |

| Sustainalytics Second-Party Opinion (June 2024) | Download PDF |

| Sustainability Bond Framework (February 2022) | Download PDF |

| Sustainalytics Second-Party Opinion (February 2022) | Download PDF |

For all enquiries please contact: treasury@nbnco.com.au

Fiona Trigona, Executive General Manager, Group Treasurer

Level 15, 100 Mount Street

North Sydney NSW 2060